Accounts Payable

Welcome to the New World ERP Accounts Payable Processing online guide. This document will guide you through both the setup and processing aspects of Accounts Payable Processing. It is divided into two sections, System Administration and End User Processing.

System Administration. This section focuses on the setup components necessary to utilize the Accounts Payable Processing module within New World ERP. This will include detailed information on master files that must be set up such as Sales Tax Codes and Invoice Terms. This guide will also include the security settings which will be utilized to enable workflow and tailor user options to your needs.

End User Processing. This section describes the steps, workflow, and options available in Accounts Payable Processing to the end-user. It will guide you through the process from Invoice Entry to Payment Processing. Included in the section will be a guide to the standard reports available in the software.

This document is available in Microsoft Word format to allow for customization to your organization’s particular needs and procedures.

System Administrator

Validation Sets

There are multiple validation sets used in the Accounts Payable module. Some need to be set up in order to perform the next steps in the general setup process.

- #22 Check Form Type – A separate entry will need to be added to this validation set for each printed check format to be used. If only one AP check layout is required, an AP Check value is typically created.

- #24 Name Suffix – These suffixes are available for selection when creating vendors or, when entering vendor information on the Temporary Vendor method of invoice entry.

- #29 Hold Payment Reason – These reasons are available for selection during invoice entry. The application will not allow a payment to be created for any invoice that has a hold payment reason attributed to it. The hold payment reason must be removed before the invoice will be eligible to be paid. Some common hold payment reasons are Department Requested Hold, Awaiting W9 , and Disputed Invoice.

- #30 Unit of Measure – These units of measure are used when entering the detail items onto an invoice. Some common units of measure are Each, Case, Box, Gallon, Ton, Pound, etc.,

- #32 Positive Pay Format – A separate entry will need to be added to this validation set for each positive pay file format that is to be used.

- #38 Employee – Employees should be entered in this validation set if the organization has not licensed the Human Resources application and intends to use the Receipt of Goods module. This will enable Receipt of Goods Shippers to be attributed to the employee that actually took possession of the respective goods or, services.

- #45 ACH File Format – A separate entry will have to be added to this validation set for each ACH file format that will be used.

- #258 AP Payment Sort Group – These groups are available for selection during invoice entry. When checks are printed, all the checks for invoices attributed to a particular group will print together. Some common payment sort groups are Employee and Department Return.

- #239 “Request for Payment” Form Type – This validation set dictates the options that are available for selection when setting the request for payment form type in Company FM Settings. There is only one standard request for payment form type, so the common value is Standard.

- #244 Receipt of Goods Adjustment Reason – These reasons are available for selection when making adjustments to items on receipt of goods shippers. Some common reasons are Correction and Entry Error.

- #329 Void Payment Reason – These reasons are available to be selected when voiding a check or, EFT payment. Some common void payment reasons are Wrong Vendor, Duplicate, Stale Dated, and Wrong Amount.

- #349 Void Invoice Reason – These reasons are available to be selected when voiding an invoice. Some common void invoice reasons are Wrong Vendor, Duplicate, Wrong Amount, and Wrong GL Account.

Vendors

Vendors must be set up under Maintenance > new world ERP Suite > Procurement > Vendor Service in order for invoices to be attributed to them during the accounts payable invoice entry process.

Items

Items need to be set up under Maintenance > new world ERP Suite > Procurement > Items. The item is needed to satisfy a required field on the invoice entry screen. These items can be used for analysis, account enforcement, and to trigger the creation of a pending asset.

Bank Accounts

All Bank Accounts that accounts payable invoices could be paid from need to be setup under Maintenance > new world ERP Suite > Banks.

Company FM Settings

The Company FM Settings area contains universal settings that control system behavior within the Accounts Payable Module.

Accounts Payable Tab

Maintenance > Financial Management > Company FM Settings>Accounts Payable Tab

Fields:

Unit of Measure – Select the default Unit of Measure that should display for items. This value is required. This default is used on the Requisition, Purchase Order, and Purchase Order Template pages in Purchasing.

Maximum Payment Amount – Type an amount in Maximum Payment Amount. This value is the maximum amount for which a check should be written. The acceptable range is $0.01 through $999,999,99.99. The system will provide a warning whenever a payment is created over this amount. This field is required.

Apply Discount – This check box dictates whether the Apply Discount check box for items entered on an AP Invoice Entry screen will default to being selected or, cleared.

Process Discounts During – Select the time at which discounts are processed (e.g., invoice processing or, payment processing). This dictates when discounts will be recognized and journalized.

- If Invoice Processing is selected, discount amounts entered in the Discount Amount field on the Invoice Entry screen will be recognized and journalized when the Invoice Entry Batch is posted.

- If Payment Processing is selected, discount amounts in the Discount Amount field on the Invoice Entry screen will be recognized and journalized when the Invoice Payment Batch is posted. This will happen if, and only if, the check date for the Invoice Payment Batch falls within the discount period. Payment Processing cannot be selected if any invoices in the system are in either an Edit or, Open status.

Invoice Due Date Based On – This setting dictates how the Due Date Based on field populates on the Invoice Batch Entry Page.

- If set to Blank, the Due Date Based on field on the Invoice Batch Entry Page will default to Blank.

- If set to Balance Period, the Due Date Based on field on the Invoice Batch Entry Page will default to Balance Period.

- If set to Discount Period, the Due Date Based on field on the Invoice Batch Entry Page will default to Discount Period.

Use P.O. Address as Remittance Address –

- If selected, when an invoice is created, the address entered on the purchase order overrides the primary remittance address defined in the vendor record as long as the vendor’s purchasing contact that the purchase order is attributed to is flagged as a remittance contact as well.

Setting for Complete P.O. Item –

- If selected, this causes the Completes Item check box on the Select Purchase Order method of invoice entry to default to being selected.

- If cleared, the check box will default to cleared on the Select Purchase Order method of invoice entry.

Taxable Item – This check box dictates whether the Apply Taxes check box for items entered on an AP Invoice Entry screen will default to being selected or, cleared.

Payroll Disbursement Item – This setting dictates the Item to be attributed to Payroll Disbursement Invoices being created using the HR Disbursements method of invoice creation.

Pension Loan Item – This setting dictates the Item to be attributed to Pension Loan Invoices being created using the HR Disbursements method of invoice creation.

Worker’s Compensation Claim Item – This setting dictates the Item to be attributed to Worker’s Compensation Claim Invoices being created using the HR Disbursements method of invoice creation.

Group Workers Comp Invoices – This setting defines whether this subset of invoices is grouped by Vendor and Employee, or by Vendor. The default value is Vendor and Employee.

Purchase Order Balances –

- If set to Original Amount, only the original amount entered for each purchase order item will display on the Select Purchase Order method of invoice entry.

- If set to Remaining Amount, both original amount and the remaining amount for each purchase order item will display.

Apply Freight – This check box dictates whether the Apply Freight check box for items entered on an AP Invoice Entry screen will default to being selected or, cleared.

Distribution Method – Select a value to determine how freight charges entered into the Freight Amount field on the invoice entry screen should be charged to the general ledger. The default value is Line Item, other options are Organization, and G/L Account.

- If Line Item is selected, amounts entered into the Freight Amount field will be allocated to the G/L Accounts the items on the invoice are being charged to. This is done proportionately for each item’s (that is flagged to Apply Freight) percent of the total invoice amount.

- If Organization is selected, amounts entered into the Freight Amount field will be allocated to the Account selected in the Distribution Account field within the G/L Organization Set the invoice items are being charged. This is done proportionately for each item’s (that is flagged to Apply Freight) percent of the total invoice amount.

- If G/L Account is selected, amounts entered into the Freight Amount field will be allocated entirely to the G/L Account selected in the Distribution G/L Account field.

Default Retainage Released Invoice Description – The header description entered here will default into invoices entered using the Release Retainage method of invoice creation.

Use Blind Receipt Entry –

- If selected, when receipting against a purchase order, the quantity will default to zero for all items on the purchase order.

- If cleared, the application will show the remaining quantity for all items on the purchase order being receipted against.

Auto-Print “Request for Payment” Form – If selected, the application will automatically print the Request for Payment form to the default printer (established in the form layout setup) each time a receipt of goods is saved.

“Request for Payment” Form Type – This dictates the layout to be used for the Request for Payment form. The options are defined in Validation Set 239, Request for Payment Form Type.

Centralized Accounts Payable Department –

- If a value is selected, all journals from the sub-ledger will be assigned to this central department.

- If not defined, the post may make multiple journals, one for each department specified on an invoice entry batch.

Increment Counter Numbers Based on Fiscal Year –

- If selected, Invoice Entry Batch numbers and system assigned Invoice numbers will use the fiscal year value as the prefix (i.e., Counter Year).

- If cleared, the calendar year is used as the prefix.

Allow Changes to Approved Invoices –

- If selected, the application will allow users to make changes to invoices within an approved Invoice Entry Batch.

- If cleared, all approvals must be removed before changes can be made.

Validation and Approval Sequence – This setting dictates the order that the validation and approval stages of the workflow are to be performed for an Invoice Entry Batch.

- Require Approvals for Validation - If selected, the invoice entry batch must be fully approved before it is eligible to be validated.

- Require Validation for Approvals - If selected, the invoice entry batch must pass validation before it is eligible to be approved.

- Require No Dependencies - if selected, added invoices can be validated and approved in any sequence.

- Require Validation for Approvals - This is the most common selection. When selected, the application is checking the transactions entered before a personal approval is applied.

Verify Date is Prior to PO GL Date – This setting helps ensure that appropriate dates are being used when an invoice is entered against a purchase order.

- Do Not Check - allows users to enter an invoice with a G/L date that precedes the G/L date of the purchase order.

- Give a Warning - allows users to enter an invoice with a G/L date that precedes the G/L date of the purchase order. A warning message alerting users that the action will take place if they choose to proceed. This warning will be displayed.

- Do Not Allow - prevents users from entering an invoice with a G/L date or, invoice date that precedes the G/L date of the purchase order.

Use Invoice Date or Invoice GL Date – Select either the Invoice G/L Date, Invoice Date, or Both date values to prevent users from entering an invoice that precedes the G/L date of the purchase order.

Require Invoice Received Date –

- If selected, the application will require an invoice received date be specified on the Accounts Payable Invoice Entry pages. This is the date that the invoice was physically received; it allows users to compare the date with other significant AP invoice dates (e.g., entry date, posted date, paid date).

- If cleared, entering the Invoice Received Date is optional.

Manual Invoice Number Entry – This field determines whether entering an AP invoice number is required (it cannot be left blank), optional (the system will assign the number if the field is blank), or whether a warning should be issued if the field is left blank.

Update 1099 Information During P-Card Import – This setting dictates whether, or not 1099 transactions will be created for the informational invoices created during the P-Card Import.

Allow Cash Basis Processing – Check to enable cash basis processing in Accounts Payable. A journal entry setting up Accounts Payable will not be recorded during the Invoice Entry process if cash basis is selected. Neither will a journal entry relieving Accounts Payable be recorded during the Invoice Payment process if cash basis is chosen. Under the cash basis method, a journal debiting the expense and crediting cash will be posted to the general ledger upon payment of the invoice.

- If selected, the desired Funds must also be set to cash basis in the Accounts Payable Accounting Method Field. Funds can be updated through Maintenance > new world ERP Suite > Chart of Accounts > Funds. Click on the code to update settings on the respective Fund.

Payment Form Order – This setting dictates the order that AP checks are printed.

- Vendor Name - checks will print in alphabetical order by vendor name.

- Vendor Number - checks will print in numeric order by vendor number.

Include Item Descriptions on Payment Stubs –

- If selected, detail items will print on the check stub as a sub-set of the summary invoice information (invoice date, invoice number, invoice header description, and invoice amount) that they pertain to.

- If cleared, only the invoice date, invoice number, invoice header description, and invoice amount will print on the check stub.

Note: This greatly increases the frequency of stub information overflowing the stub portion of the check.

Validation and Approval Sequence – This setting dictates the order that the validation and approval stages of the workflow are to be performed for an Invoice Payment Batch.

- Require Approvals for Validation - if selected, the invoice payment batch must be fully approved before it is eligible to be validated.

- Require Validation for Approvals - if selected, the invoice payment batch must pass validation before it is eligible to be approved.

- Require No Dependencies - if selected, added invoices can be validated and approved in any sequence.

- Require Validation for Approvals - This is the most common selection. The application checks the transactions entered before a personal approval is applied.

Payment Creates Negative Cash Balance – This setting dictates how invoice payments are handled if cash entries cause a negative balance. The system setting can be used to prevent payments (checks/EFTs) from being generated if cash entries cause a negative balance in the selected fund.

- Do Not Check - allows users to process an invoice payment even when payments cause a negative balance.

- Give a Warning - allows users to process an invoice payment when payments cause a negative balance, but displays a warning message alerting users that the action will take place if they choose to proceed.

- Do Not Allow - prevents users from processing an invoice payment when payments cause a negative balance.

Invoice Terms

Maintenance>new world ERP Suite>Miscellaneous Definitions>Invoice Terms

Invoice Terms allow an organization to maintain terms that define when vendors expect payment (e.g., 30 days or, on the 1st day of the next month). Invoice terms may also include discount periods calculated by discount terms (e.g., 2% 10, Net 30). The discount period and terms specify if the organization makes payment in full within the agreed upon number of days from the Invoice Date, the organization is eligible to receive a discount.

Invoice Terms can be used to automatically populate the Invoice Due Date and automatically calculate the discount amount based on the discount percent established by the Invoice Term identified. The automatic calculation and application of the discount amount only occurs if the Process Discounts During field in Company FM Settings is set to Payment Processing and the invoice is paid within the Discount Period for the Invoice Term it is attributed to.

Creating Invoice Terms

To add invoice terms, click the New button along the bottom of the Invoice Term List page. To work with existing invoice terms, click the term code hyperlink to open the record.

Fields:

Active – New invoice terms default to Active. If an invoice term is no longer applicable, it can be deactivated by clearing the check box and then clicking the Save button.

Term Code – Enter an alphanumeric code that identifies the invoice term (e.g., Net 30). The code must be unique. There are no character restrictions. The maximum character length is 16; the minimum is 1.

Description – Enter a textual description of the invoice term. The maximum character length is 32; the minimum is 1. There are no character restrictions.

Effective Date – Displays the effective date range of the invoice term. This field is disabled when adding a new invoice term. Once the term is created, the field will display all applicable effective date ranges used with the term.

Start Date – Enter or, select the date on which the invoice term goes into effect.

Discount Method – This field dictates how the eligible date range for the discount is determined.

- If Discount Period is selected, the discount is eligible as long as the invoice is paid on a date that falls between the invoice date, and the invoice date plus the number of days referenced in the Discount Period field. The Balance Period field dictates when the invoice is due if the discount is not taken.

- If Current Month is selected, the discount is eligible as long as the invoice is paid by the numeric date (e.g., 15th day of the month) referenced in the Discount Due Day field within the month the respective invoice date falls within.

- If Next Month is selected, the discount is eligible as long as the invoice is paid by the numeric date referenced in the Discount Due Day field within the month, after the month the respective invoice date falls within.

Discount Percentage – Enter a numeric value that defines the percentage discount given if the balance is paid within a specified period of time.

Method –Select a value to determine how discount amounts entered into the Discount Amount field on the invoice entry screen should be charged to the general ledger. The default value is Line Item, other options are Organization and G/L Account.

- If Line Item is selected, amounts entered into the Discount Amount field will be allocated to the G/L Accounts the items on the invoice are being charged to. This is done proportionately for each item’s (that is flagged to Apply Discounts) percent of the total invoice amount.

- If Organization is selected, discount amounts entered into the Discount Amount field will be allocated to the account selected in the G/L Account field within the G/L Organization Set the invoice items are being charged to. This is done proportionately for each item’s (that is flagged to Apply Discounts) percent of the total invoice amount.

- If G/L Account is selected, then amounts entered into the Discount Amount field will be allocated entirely to the G/L Account selected in the G/L Account field.

After filling the required fields on the Invoice Term screen, click the Save button to create the term. Once the term has been created, it is eligible to be selected on Vendor master files. When selected it will automatically populate onto all new invoices created for that Vendor, or, it can be selected on an invoice-to-invoice basis during accounts payable invoice entry. Click Save/New to save the record and create another invoice term on the same page without having to return to the list page.

Sales Tax Codes

Maintenance>new world ERP Suite>Miscellaneous Definitions>Sales Taxes

Sales Tax Codes give an organization the ability to track the sales tax a municipality must pay on goods purchased. If vendors do not add sales tax to their invoices, a municipality may still be responsible for paying the appropriate tax to the collecting entity (local, city, county or state).

Creating Sales Tax Codes

To add sales tax codes click the New button along the bottom of the Sales Tax List page. To work with existing sales tax codes, click the hyperlink in the Tax Code column to open the record.

Fields:

Active – New sales tax codes default to Active. When a sales tax code is no longer applicable, it can be deactivated by clearing the Active check box, and then clicking the Save button.

Tax Type – Select the type of sales tax code being defined. The options are State, County, and Local/City.

Tax Code – Type an alphanumeric code that uniquely identifies the sales tax code. The code can contain up to 16 characters. There are no character restrictions. The combination of Tax Type and Tax Code must be unique.

Description – Type a brief description of the tax code. The description can contain up to 32 characters, with no character restrictions.

Effective Date – Displays the effective date range of the sales tax code. This field is disabled when a new sales tax code is being added. This field will display all applicable effective date ranges used with the tax code, once the tax code is created.

Start Date – Enter or, select the date on which the sales tax code goes into effect.

Tax Percentage – Enter the percentage of tax that will be assessed when this tax code is used. The number must be between 0.01% and 999.99%.

Maximum Amount – Enter the maximum dollar amount that can be assessed using the tax code. The amount must be a number between $0.00 and $999,999,999.99.

Method – Select a value to determine how tax amounts entered into the respective tax field on the invoice entry screen should be charged to the general ledger. The default value is Line Item, other options are Organization and G/L Account.

- If Line Item is selected, the amounts entered into the respective tax field will be allocated to the G/L Accounts that the items on the invoice are being charged. This is done proportionately for each item’s (that is flagged to Apply Taxes) percent of the total invoice amount.

- If Organization is selected, the discount amounts entered into the Discount Amount field will be allocated to the Account selected in the Account field within the G/L Organization Set the invoice items are being charged. This is done proportionately for each item’s (that is flagged to Apply Taxes) percent of the total invoice amount.

- If G/L Account is selected, amounts entered into the Discount Amount field will be allocated entirely to the G/L Account selected in the G/L Account field.

After filling the required fields on the Sales Tax entry screen, click Save to create the Sales Tax Code or, Save/New to save the record and create another sales tax code on the same page without having to return to the list page. Once the code has been created, it must be selected on applicable vendor master files so that the respective tax field (State, County, Local/City) automatically populates onto all new invoices created for that vendor.

User Defined Fields (UDFs)

Maintenance > new world ERP Suite > Security > User Defined Fields

User Defined Fields (UDFs) can be used in Accounts Payable to capture additional information about an invoice that is not facilitated by the standard fields on the invoice entry screens. To set up UDF, navigate to the User-Defined Field list screen.

First, select the appropriate Record Type. The Record Types for Accounts Payable UDFs will be Procurement Forms and Procurement Items. UDF attributed to the Record Type of Procurement Forms pertain to the invoice as a whole. UDF attributed to the Record Type of Procurement Items pertain to individual items on an invoice.

If UDF Section Headers are desired, they can be set-up by selecting the Maintenance Type of Section Headers.

The sequence number field will sequence the Section Headers on the UDF screen in numerical order.

Creating User Defined Fields

Maintenance > new world ERP Suite > Security > User Defined Fields.

To add UDF, change the Maintenance Type to Attributes, then click the New button to add a new field.

Fields:

Name – This is the title of the User Defined Field.

Section Header – If appropriate, select the Section Header that the Attribute should appear within.

Sequence Number – This will determine the order in which the field is presented within the section header.

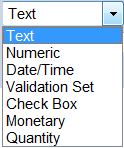

Data Type - This drop-down has the following options:

Text – Select this option if the desired field should be text specific. If selected, an additional field will request the maximum number of allowable characters for the field. The options for this entry are 1 to 999.

Numeric – Select this option if a number should be entered in the UDF. If selected, an additional prompt will request the minimum and maximum allowable values. These can be set to negative amounts if desired.

Date/Time – Select this option if a Date/Time should be shown for the User Defined Field.

Validation Set – Select this option if the UDF should present the user with a drop-down from a validation set. If selected, an additional prompt will require specification of the validation set to use. If an additional validation set is required, go to Maintenance>new world ERP Suite>System>Validations Sets>Validation Set List. Click New to create an additional validation set and its entries. A unique (unused) number will be required for any new Validation Set created.

Check Box – Select this option if the UDF should be a simple True/False which can be accomplished by utilizing a check box.

Monetary – This allows for entry of a monetary figure. If selected, the user may specify the desired number of decimal places which can be useful for per unit information.

Quantity – Select this option if quantity information should be recorded in the UDF. If selected, an additional prompt will request the number of decimal places to be recorded.

Required – The Required field will require a user put an entry into the field when accessing the UDF during invoice entry.

Available Applications – Select the applications where the user defined field will be available to use.

- If the record type of Procurement Forms is selected, the options pertaining to accounts payable are Accounts Payable Invoices and Accounts Payable Invoice Templates.

- If the record type of Procurement Items is selected, the options pertaining to accounts payable are Accounts Payable Invoice Items, and Accounts Payable Invoice Item Templates.

After creating the desired UDF, the list of UDF will populate the User Defined Field List screen. They can be edited or, changed by clicking on the Attribute Name to re-open them.

Security Setup

Security for Accounts Payable Processing is controlled through User Based Security, Application Permissions, and Process Manager Setup.

Application Permissions

The Application Permissions for Accounts Payable Processing can often be completed effectively within two general template groupings. However, more compartmentalized templates might be necessary depending on how large an organization is, and how restrictive an organization wants to be in making sure users only have access to the areas of processing pertaining to their specific job duties.

The first general delete template is for invoice entry purposes and typically contains all permissions in the A/P Invoice Processing and Accounts Payable Reports feature groups. The second general template is for invoice payment purposes, and generally contains all permissions in the A/P Payment Processing and Accounts Payable Reports feature groups as well as most of the permissions in the Payment Processing feature group.

Permission Type – Company Applications

Feature Group – A/P Invoice Processing

|

App |

Component |

Description |

All |

Add |

Change |

Delete |

View/Use |

|

|---|---|---|---|---|---|---|---|---|

|

FM |

AP Invoice Import |

The ability to use the invoice import process. |

x |

|

x |

|

|

|

|

FM |

G/L Distributions |

The ability to work with a multiple G/L Account distribution during invoice entry. |

x |

x |

x |

x |

x |

|

|

FM |

Import Accounts Payable Purchasing Card |

The ability to use the P-Card import process. |

x |

|

x |

|

|

|

|

FM |

Invoice Batch Entry |

The ability to create, make changes to, and delete invoice batches. |

x |

x |

x |

x |

x |

|

|

FM |

Invoice Batch Process Manager |

The ability to take invoice batches through the stages of the workflow. |

x |

|

|

|

x |

|

|

FM |

Invoice Batch Process Manager – Execute All Processes |

The ability to use the Execute All option in processing an invoice batch. |

x |

|

x |

|

|

|

|

FM |

Invoice Batch Process Manger - Post |

The ability to perform the Post stage of the workflow for an invoice batch. |

x |

|

x |

|

|

|

|

FM |

Invoice Batch Process Manger – Print Edit & Error Listing |

The ability to generate the invoice batch Edit and Error Listing. |

x |

|

|

|

|

x |

|

FM |

Invoice Batch Process Manger - Validate |

The ability to perform the validation stage of the workflow for an invoice batch. |

x |

|

x |

|

|

|

|

FM |

Invoice Batch Search |

The ability to access the invoice batch list. |

x |

|

|

|

x |

|

|

FM |

Quick Vendor Invoice |

The ability to use the Quick Invoice method of invoice entry. |

x |

x |

|

|

x |

|

|

FM |

Template Invoice Batch Entry |

The ability to create, change, and delete template invoice batches. |

x |

x |

x |

x |

x |

|

|

FM |

Template Invoice Batch Listing |

The ability to print a listing of template invoice batches and the detail of the invoices contained within. |

x |

|

|

|

|

x |

|

FM |

Template Invoice Batch Search |

The ability to see template batches in the template page in an invoice batch. |

x |

|

|

x |

x |

|

|

FM |

Template Invoice Entry |

The ability to create, change, and delete template invoices within template invoice batches. |

x |

x |

x |

x |

x |

|

|

FM |

Template Invoice Search |

The ability to see template invoices within a Template Invoice Batch in the template page in an invoice batch. |

x |

|

|

x |

x |

|

|

FM |

Temporary Vendor Invoice Entry |

The ability to use the Temporary Vendor method of invoice entry. |

x |

x |

x |

x |

x |

|

|

FM |

Vendor Invoice Entry |

The ability to use the full or standard method of invoice entry. |

x |

x |

x |

x |

x |

|

|

FM |

Vendor Invoice Search |

The ability to see the invoice section within the Vendor Inquiry. |

x |

|

|

|

x |

|

|

FM |

Associate Transaction to Asset |

The ability to associate an invoice item to an existing asset record. |

x |

|

x |

x |

x |

|

|

Suite |

Contacts |

The ability to choose from Vendor remittance contacts. |

x |

x |

x |

x |

x |

|

|

Suite |

Import Accounts Payable Purchasing Card – Edit Listing |

The ability to generate the edit listing during the P-Card Import process. |

x |

|

|

|

|

x |

|

Suite |

Import Accounts Payable Purchasing Card – Error Listing |

The ability to generate the error listing during the P-Card Import process. |

x |

|

|

|

|

x |

Permission Type – Non-Company Applications

Feature Group – A/P Invoice Processing

|

App |

Component |

Description |

All |

Add |

Change |

Delete |

View/Use |

|

|---|---|---|---|---|---|---|---|---|

|

Suite |

Vendor Inquiry |

The ability to use the Vendor Inquiry. |

x |

|

|

|

x |

|

Permission Type –Company Documents and Notes

Feature Group – A/P Invoice Processing

|

App |

Component |

Description |

All |

Add |

Change |

Delete |

View/Use |

|

Checkout |

Undo |

Finalize |

Reminder |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

FM |

AP Invoice Notes |

Ability to add Notes in invoice entry and inquiry. Any user attaching notes to the AP Invoices will need this permission. |

ü |

ü |

ü |

ü |

ü |

ü |

|

|

|

|

|

FM |

Template Invoice Documents |

Ability to add, view, and work with documents when creating or, maintaining template invoices. |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

|

FM |

Vendor Invoice Documents |

Ability to add, view, and work with documents in invoice entry and inquiry. |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

Permission Type –Company Applications

Feature Group – A/P Payment Processing

|

App |

Component |

Description |

All |

Add |

Change |

Delete |

View/Use |

|

|---|---|---|---|---|---|---|---|---|

|

FM |

Accounts Payable – Create Manual Payment Batch Register |

The ability to create the Manual Payment Batch Register for an invoice batch with invoices flagged for manual checks within the batch. |

x |

x |

|

|

|

|

|

FM |

Accounts Payable – Create Payment Batch Register |

The ability to create the payment batch register for a traditional invoice payment batch. |

x |

x |

|

|

|

|

|

FM |

Accounts Payable Payment Process Manager |

The ability to take invoice payment batches through the stages of the workflow. |

x |

|

|

|

x |

|

|

FM |

Accounts Payable Payment Process Manager – Output Preferences |

The ability to define output preferences when performing the Print Edit & Error Listing stage of the workflow. |

x |

|

|

|

x |

|

|

FM |

Accounts Payable Payment Process Manager – Post Payment Batch and Voided Invoices |

The ability to perform the post stage of the workflow for invoice payment batch. |

x |

|

x |

|

|

|

|

FM |

Accounts Payable Payment Process Manager – Print Edit & Error Listing |

The ability to perform the Print Edit and Error listing stage of the workflow for invoice payment batch. |

x |

|

|

|

|

x |

|

FM |

Accounts Payable Payment Process Manager – Validate Payment Batch |

The ability to perform the validation stage of the workflow for an invoice payment batch. |

x |

|

x |

|

|

|

|

FM |

Accounts Payable Payment Process Manager – View Errors |

The ability to view the errors created during the validation stage of the workflow. |

x |

|

|

|

x |

|

|

FM |

AP Invoice Import Audit Listing |

The ability to generate the audit listing when using the invoice import process. The audit listing shows any errors or, warnings generated from the import file. |

x |

|

|

|

|

x |

|

FM |

AP Invoice Import Edit Listing |

The ability to generate the Edit Listing when using the invoice import process. |

x |

|

|

|

|

x |

|

FM |

AP Invoice Import New Payee Listing |

The ability to run a listing of new payees created during the invoice import process. |

x |

|

|

|

|

x |

|

FM |

Invoice Payment Batch Maintenance |

The ability to create and make changes to invoice payment batches. |

x |

x |

x |

x |

x |

|

|

FM |

Select Invoice for Payment |

The ability to select invoices to be paid within invoice payment batches. |

x |

|

x |

|

x |

|

|

FM |

Void Vendor Invoice |

The ability to select invoices to be voided within invoice payment batches. |

x |

|

x |

|

x |

|

|

FM |

Cash Requirement Listing |

The ability to generate a Cash Requirement Listing when performing the Create Payment Register stage of the workflow for Invoice Payment Batches. |

x |

|

|

|

x |

x |

|

FM |

Email Payment Confirmation |

The ability to email payment confirmations to vendors at the payment batch stage of the workflow for invoice payment batches. |

x |

x |

x |

x |

x |

x |

Permission Type –Company Applications

Feature Group – Accounts Payable Reports

|

App |

Component |

Description |

All |

Add |

Change |

Delete |

View/Use |

|

|---|---|---|---|---|---|---|---|---|

|

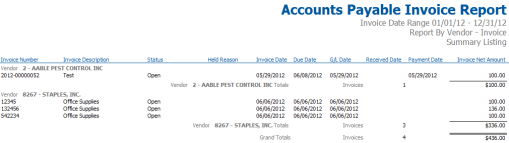

FM |

51. Accounts Payable Invoice Report |

The ability to run the Accounts Payable Invoice Report. |

x |

|

|

|

|

x |

|

FM |

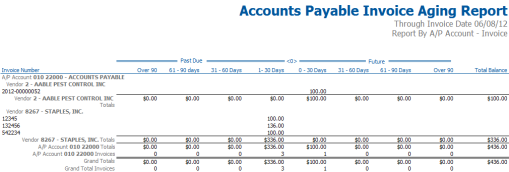

52. Accounts Payable Invoice Aging Report |

The ability to run the Accounts Payable Invoice Aging Report. |

x |

|

|

|

|

x |

|

FM |

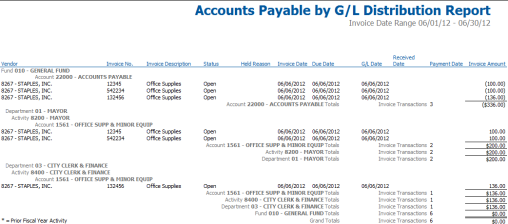

53. Accounts Payable by G/L Distribution Report |

The ability to run the Accounts Payable by G/L Distribution Report. |

x |

|

|

|

|

x |

|

FM |

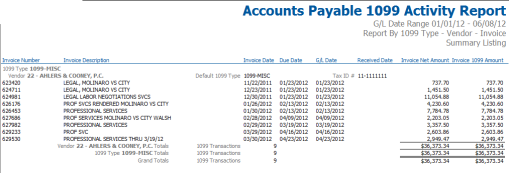

Accounts Payable 1099 Activity Report |

The ability to run the Accounts Payable 1099 Activity Report. |

x |

|

|

|

|

x |

|

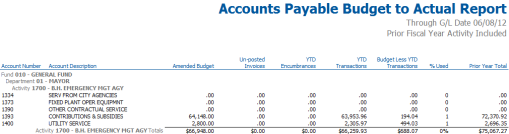

FM |

Accounts Payable Budget to Actual Report |

The ability to run the Accounts Payable Budget to Actual Report. |

x |

|

|

|

|

x |

|

FM |

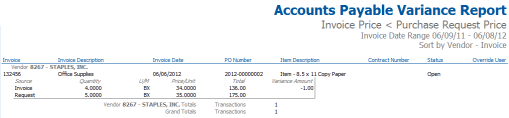

Accounts Payable Variance Report |

The ability to run the Accounts Payable Variance Report. |

x |

|

|

|

|

x |

|

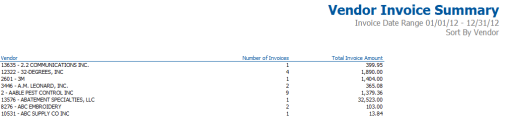

FM |

Vendor Invoice Summary |

The ability to run the Vendor Invoice Summary. |

x |

|

|

|

|

x |

Permission Type –Company Applications

Feature Group – All

|

App |

Component |

Description |

All |

Add |

Change |

Delete |

View/Use |

|

|---|---|---|---|---|---|---|---|---|

|

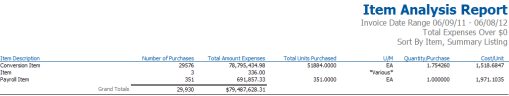

FM |

Item Analysis Report |

The ability to run the Item Analysis Report. |

x |

|

|

|

|

x |

|

FM |

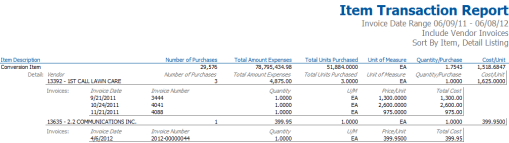

Item Transaction Report |

The ability to run the Item Transaction Report. |

x |

|

|

|

|

x |

Permission Type –Company Applications

Feature Group – Payment Processing

|

App |

Component |

Description |

All |

Add |

Change |

Delete |

View/Use |

|

|---|---|---|---|---|---|---|---|---|

|

Suite |

81. Payment Register |

The ability to run the Payment Register report. |

x |

|

|

|

|

x |

|

Suite |

ACH Transmittal File Listing |

The ability to create the ACH Transmittal File Listing in creating ACH payments in invoice. payment batches. |

x |

|

|

|

|

x |

|

Suite |

Create Payment Register |

The ability to perform the Create Payment Register stage of the workflow for invoice payment batches. |

x |

|

|

|

x |

|

|

Suite |

Payment Standard Messages |

The ability to create, change, delete Standard Messages that can be selected to print on payment stubs. |

x |

|

|

|

x |

|

|

Suite |

Payments – Batch Detail Processing |

The ability to view the details of payments contained within invoice payment batches from the payment batches stage of the workflow. |

x |

|

|

|

x |

|

|

Suite |

Payments – Batch Processing |

The ability to use the payment batches stage of the workflow for invoice payment batches. This is the stage of the workflow where the check, ACH, and positive pay files are created. |

x |

|

|

x |

x |

|

|

Suite |

Payments – Check Detail Inquiry |

The ability to see inquire on payment detail. Payment detail is primarily the invoices that are being paid. |

x |

|

|

|

x |

|

|

Suite |

Payments – Create ACH File |

The ability to create ACH files from the payment batches stage of the workflow for invoice payment batches. |

x |

x |

|

|

|

|

|

Suite |

Payments – Create Positive Pay File |

The ability to create positive pay files from the payment batches stage of the workflow for invoice payment batches. |

x |

x |

|

|

|

|

|

Suite |

Payments – Payment Batch Register |

The ability to recreate the payment register from the payment batches stage of the workflow. |

x |

|

|

|

|

x |

|

Suite |

Payments – Renumber Checks |

The ability to renumber checks from the payment batches stage of the workflow. |

x |

|

x |

|

|

|

|

Suite |

Print AP Checks |

The ability to create the check file for AP checks from the payment batches stage of the workflow. Essentially the ability to generate the checks for the invoice payment batch. |

x |

|

|

|

|

x |

|

Suite |

Print AP Checks Supplement |

The ability to create a separate file for check stub overflow when using a check format that is setup accordingly. |

x |

|

|

|

|

x |

|

Suite |

Print Payments |

The ability to use the print button to create the check file from the payment batches stage of the workflow. |

x |

|

|

|

x |

x |

User Based Security

There are multiple functions within User Based Security that must be set up to allow a user to perform both AP Invoice Entry and AP Invoice Payment.

Bank Accounts – For AP Invoice Entry, users need all bank accounts that they might want to attribute an invoice to during the AP Invoice Entry process. For Invoice Payment, users need access to all Bank Accounts that they might need to create an invoice payment batch for.

Contract Types – Users need access to the appropriate Contract Types in order to attribute AP invoice items to the individual contracts assigned to the respective Contract Type.

Project Categories – Users need use rights to the appropriate Project Categories in order to attribute AP invoice items to the individual Projects assigned to the respective Project Category.

Purchase Order Types – Users need access to the appropriate Purchase Order Types in order to be able to enter AP invoices against the individual Purchase Orders assigned to the respective Purchase Order Type.

Sub Ledgers/Accounts Payable – Determine what users will have supervisor privileges and budget override capabilities. The supervisor privilege will be necessary for any user that needs to be able to approve either invoice entry batches or, invoice payment batches created by other users. In addition, under the G/L Organization tab select the G/L Organization sets each user will be able to enter purchase orders against.

Upper Half of the General Ledger Sub Ledger Screen

Supervisor – Checking this box allows the user to view all journals (insert Accounts Payable ) created by all users on the Journal (insert Accounts Payable ) List in the Journal (insert Accounts Payable) Process Manager. Any user who reviews or approves other user’s journals (Accounts Payable batches) must have this authority. Therefore, the box must be selected. When the box is not selected, the user only sees journals (insert Accounts payable batches) they have created.

GL Budget Override Authority – Selecting this box allows this user to override over-budget warnings generated during the journal process. This permission should be limited to those users that are authorized to permit over budget situations.

Project Budget Override Authority - Selecting this box allows this user to override the over budget warning for projects. This permission should be limited to those users that are authorized to allow over budget situations for projects.

Purchase Order Override Authority – This is inactive for the general journals.

Sub-ledger Detail Authority – When this box is checked the user will be able to view the detail of journals when executing inquiries and reports in the system. If this box is not selected, the user will not be able to drill down to the detail transactions and other support of the general journal entries when executing inquiries and reports.

Process Manager

There are multiple processes that must be set up in the Process Manager to facilitate the receipt of goods process, invoice entry process, invoice payment process, and the ability to report and inquire on those respective transactions.

Accounts Payable – Invoice Entry – This process defines which departments can perform invoice entry, and the approval structure that invoice batches attributed to each department are subject to.

Accounts Payable – Invoice Payment – This process defines which departments can perform the invoice payment process, and the approval structure that invoice payment batches attributed to each department are subject to.

Accounts Payable – Receipt of Goods – This process defines which departments can perform the receipt of goods entry process. There is no approval structure for receipt of goods.

Purchasing – Procurement Inquiry – This process defines where inquiries, and reports can be generated. Determination of which departments Purchasing, Accounts Payable, and Receipt of Goods transactions can be inquired and reported upon is selected here. This process also dictates which departments’ purchase orders a user can use during invoice processing.

Accounts Payable Processing

Accounts Payable Processing falls into three main areas: Receipt of Goods, Invoice Entry, and Invoice Payment.

Receipt of Goods

Receipt of Goods is intended to allow an organization to track goods that have been received and/or, services that have been rendered. This can be used in the invoice entry process to make sure invoices are only being entered and paid for when goods have actually been received. This ensures that the organization doesn’t pay for goods and/or, services that have not been received even though the vendor may have billed for them.

Receipt of Goods Shippers (Receipt of Goods transaction) can be entered in two ways; against a Purchase Order to show what has been received against the quantity ordered or, entered from scratch (no Purchase Order to receive against).

Receipt of Goods List

Financial Management > Receipt of Goods

The Receipt of Goods list will display all Shippers entered for the current day by default. The list can be refreshed by clicking the Refresh button along the bottom of the list to make sure that the most current list of Shippers entered for the current day is displayed. The list can be re-sequenced by the items each Shipper has on it by selecting the Show by Item check box along the top of the list.

To display a previous day’s Shippers or, narrow down list contents, click the  icon in the upper-left corner of the list to limit results using search criteria.

icon in the upper-left corner of the list to limit results using search criteria.

Fields:

The entered criteria determines the Shippers displayed in the list.

Department – This field can be used to isolate Shippers attributed to a particular department.

Location – This field can be used to isolate Shippers attributed to a particular Location.

From Receipt Date/To Receipt Date – These fields can be used to isolate Shippers with a Receipt Date in between the respective to and from date range.

Purchase Order – Enter a purchase order number to isolate Shippers that were entered against a specific purchase order.

Item – Select an item to isolate Shippers where the respective item has been received.

Vendor – Select a vendor to isolate Shippers attributed to that respective vendor.

Vendor Shipper – Enter a Shipper number to isolate a specific Shipper.

Receipting Against a Purchase Order

To pull up a fresh Shipper (Receipt) entry screen, click the New button on the lower-left hand corner of the Receipt of Goods list. The Add Receipt entry screen will appear.

The users’ home Department and Location will default in for the Shipper. If either needs to be changed for this Shipper, it can be done by clicking on the pencil icon on the far right-hand side of the screen which will open the Change Defaults pop-up.

The Shipper entry screen is divided into two main sections. The General Section pertains to the receipt as a whole and the Receive Items Section which falls beneath the Vendor and Purchase Order Fields. When receipting against a purchase order, the fields in the Receive Items section should not be used as the items will be selected directly from the Purchase Order.

General Section

Fields:

Date – The date will default to today’s date. It can be changed if necessary.

Received By – This field is intended to indicate who actually took possesion of the respective goods or, services. If the organization has licensed the Human Resources application, the options in the Received By field will pull from the Employee Master files. If the organization has not licensed the Human Resources application, the options in the field will pull from Validation Set #38 – Employee.

Vendor – When the vendor is selected, the application will display all open purchase orders for that vendor beneath the General Section. If a purchase order number is entered into the Purchase Order field before a vendor is selected, the Vendor field will populate automatically with the vendor the purchase order is attributed to.

Vendor Shipper Number – A shipper number can be entered into this field or, the field can be left blank. If left blank, the application will assign a shipper number using the standard numbering convention of the four digit year followed by the next sequentially available number. If a packing slip number was provided by the vendor, this is often keyed in as the shipper number.

Comment –Text comments can be entered up to 64 characters.

Purchase Order – If the purchase order number is known, it can be keyed directly into this field. The purchase order can be inquired on by clicking the scope icon to the right of the field. After the purchase order is selected, the purchase order and its items will display beneath the General Section.

Once the General Section is filled out, the user needs to select the items to be receipted onto the Shipper from the respective purchase order(s).

In the table where the purchase order and its items are displayed, there are check boxes along the left side to select which items are to be receipted onto the Shipper. Select the check box to the left of the purchase order number to select all of the items on the purchase order. If only certain items need to be included, select the check box to the left of each individual item. For the selected items the Quantity field, Unit of Measure field, and Completes PO Item check box become available. If a user wants to inquire on the purchase order, the purchase order number is a hyperlink that will open a pop-up inquiry.

Fields:

Quantity – Enter the quantity to be receipted in. The quantity that defaults in is dependant on the Use Blind Receipt Entry check box on the Accounts Payable tab in Company FM Settings. If Use Blind Receipt Entry is selected, the Quantity field defaults to 0. If Use Blind Receipt Entry is cleared, the remaining quantity (quantity not yet receipted in) will default into the field.

Unit of Measure – This field will default to the Unit of Measure that was selected when the purchase order was created.

Completes PO Item – When selected, this item will complete from the purchase order when the shipper is invoiced against it, releiving any remaining encumbrance. If left cleared, the remaining quantity will be left open on the purchase order. This box should be selected if the entire quantity for the item is being received or, if the remaining quantity is no longer needed.

After the appropriate items have been selected, click the Apply button to add them to the Shipper. After clicking the Apply button, the selected items from the purchase order will appear in the item list for the Shipper.

The item can be reopened to reference a quantity returned or, back ordered by clicking on the value in the Item column. The item can be removed from the Shipper by clicking on the Red X in the last column of the item list.

Additional items can be added to the Shipper from scratch (not pertaining to a purchase order) by using the fresh item entry section that appears on the left of the Receive Items Section of the Shipper entry screen. These fields will be described in detail in the next section.

Buttons:

If all of the necessary items have been added to the Shipper, and no additional Shippers need to be added at this time, click the Save button. If additional items need to be added from scratch, the Save/New Item button can be used to save what has been entered thus far and open up a fresh item entry section on the left of the Receive Items Section of the Shipper entry screen. If all of the necessary items have been added, and additional Shippers need to be added, the Save/New Receipt button can be used to save what has been entered, and open a fresh Shipper entry screen as a whole. The Reset button can be used to reset the Shipper back to its status as of the last save.

Receipting without a Purchase Order

To pull up a fresh Shipper entry screen, click the New button along the lower left-hand corner of the Receipt of Goods list.

The fields in the General Section are the same as when receipting against a purchase order with the exception of the Purchase Order field. The Purchase Order field would not be used when receipting from scratch. After the vendor has been selected, any open purchase orders for that vendor will display by default. To hide these purchase orders, and open the Receive Items Section of the Shipper entry screen, click the double arrow icon just beneath the Vendor field.

Fields:

Item – Select the Item to be used. There are three icons to the right of the Item field. The first icon is Search  , which opens a pop-up where additional criteria can be used to search for the appropriate item. The second icon is Analysis

, which opens a pop-up where additional criteria can be used to search for the appropriate item. The second icon is Analysis  . A value must be selected from the Item drop-down before selecting this icon. Once clicked, the Procurement Analysis pop-up appears, showing historical purchase information for the item. The third icon is Detail

. A value must be selected from the Item drop-down before selecting this icon. Once clicked, the Procurement Analysis pop-up appears, showing historical purchase information for the item. The third icon is Detail  which can be used to change how items display in the drop-down and the primary field being used to search by (Description, Quick Code, and Item Number.)

which can be used to change how items display in the drop-down and the primary field being used to search by (Description, Quick Code, and Item Number.)

Description – Enter a textdescription for the item. Up to 64 characters may be entered.

Quantity – Enter the quantity to be receipted in.

Returned – Enter the quantity that was returned to the vendor if applicable.

Unit of Measure – Select the appropriate unit of measure for the items being received.

Comments – Enter any comments that are specific to this item on the Shipper.

Backordered Quantity – Enter any quantity that needs to be referenced on back order for the shipper. This is for informational purposes only.

Backordered Delivery Date – Enter the expected delivery date for the back ordered quantity if available.

Buttons:

If all of the necessary items have been added to the Shipper, and no additional Shippers need to be added at this time, click the Save button. If additional items need to be added from scratch, the Save/New Item button can be used to save what has been entered thus far, and open up a fresh item entry section on the left of the Receive Items Section of the Shipper entry screen. If all of the necessary items have been added, and additional Shippers need to be added, the Save/New Receipt button can be used to save what has been entered, and open a fresh Shipper entry screen as a whole. The Reset button can be used to reset the Shipper back to its status as of the last save.

Adjusting a Receipt of Goods Shipper

Shippers can be adjusted after the initial entry if corrections need to be made. This is usually done to correct entry errors, or, to correct the Shipper when it is determined that items need to be returned after the initial entry. To make adjustments to a Shipper after the initial entry, click on the vendor hyperlink to the right of the shipper number that has to be adjusted from Receipt of Goods list to re-open the shipper.

To open the item that has to be adjusted, click on the value in the item column of the item list on the Shipper.

The application recognizes that the item is being adjusted, and will bring in two additional fields; Adjustment Date and Reason.

Fields:

Adjustment Date – The date will automatically populate with today’s date but, it can be changed if necessary.

Reason – The reasons available for selection pull from Validation Set #244 Receipt of Goods Adjustment Reason.

After the necessary adjustments have been made, click the appropriate Save button along the bottom of the entry screen.

Inquiries on Receipt of Goods Shippers can be made through vendor inquiry. Receipt of Goods Shippers can be reported on through the Receipt of Goods Report.

Accounts Payable Invoice Entry

Financial Management>Accounts Payable>Invoice Entry Batches

The first half of the accounts payable process is invoice entry. This process starts from the Invoice Batch List.

The Invoice Batch List shows all invoice batches that are currently open, and allows users to create new batches in order to enter more invoices. Each row in the list represents a unique invoice batch The batches a user has visibility to are determined by the departments the user is authorized toprocess for Accounts Payable – Invoice Entry in the Process Manager, and also by the Supervisor check box for the Accounts Payable Sub-ledger in User Based Security. If the user has Supervisor rights, they will be able to see all open batches for the departments to which he/she is authorized. If not, the user will only see the batches that he/she has created.

Along the top of the list, users can see the stages of the workflow that the Invoice Batch is subject to in order to become posted. Whether validation is required for approvals, or not is determined by the configuration defined on the Accounts Payable tab in Company FM Settings.

Within the list the following columns are displayed:

myTasks – A check mark in this column indicates if the batch is awaiting approval at the users assigned level in the approval structure. If there is a check mark in this column, the batch is also referenced in the myTasks section of the users’ homepage.

Validated – This column indicates if the batch has passed, failed, or not yet been submitted for validation. If the batch has passed, there will be a Green Check Mark in the column. If the batch has failed, there will be a Red X in the column. If the batch has not yet been submitted for validation, the column will be blank.

Approvals – This column indicates where each batch is at in the approval structure. The approval structure that each departments’ batches are subject to is defined in the Process Manager for the process of Accounts Payable-Invoice Entry. This value is hyperlinked to allow the user to quickly navigate into the Approval Page within the batch where invoices can be reviewed, and then, subsequently approved, returned, or denied. Users can also remove their approvals from this page. If a user hovers over this value, additional approval information is displayed.

Department – This column indicates the department that each batch is attributed to.

Batch Number – This column indicates each batch number. This value is hyperlinked to allow users to open a batch from the list if additional review, or entry work is required within the batch. If a user hovers over this value, additional information pertaining to the batch as a whole is displayed.

Batch Date – Is usually the creation date, however it can be any date useful to the organization.

Invoice Count – This column shows the number of invoices that have currently exist within the batch.

Gross Invoice – This column shows the total dollar value of the invoices that have currently exist within the batch.

Buttons:

New – Opens a fresh Invoice Batch entry screen.

Delete – Deletes whichever batch is currently selected (highlighted in yellow) in the list.

Refresh – Refreshes the list to make sure that the most up to date list of open invoice batches is being displayed.

Import – Click to begin the import process to create a batch of invoices from a file either manually created or, exported from another system.

Import Purchasing Card – Click to begin the import process to create a batch of invoices from a file created by the respective purchasing card provider.

Create Manual Payment Register – Click to create the manual payment register for an invoice batch that contains at least one invoice selected to be paid by manual check. This button is deactivated by default. It only becomes available for selection when a batch containing at least one invoice selected to be paid by manual check is contained in the list. If a batch contains manual check invoices, the batch must first have passed validation, and be fully approved before the button will become active.

Creating an Invoice Batch

Click the New button along the lower-left corner of the Invoice Batch List to open a fresh Invoice Batch entry screen.

Fields:

Invoice Batch General PageDepartment – The users’ home department will default into this field. If the user is authorized to create batches on behalf of multiple departments, the appropriate department can be selected from the options in the drop-down. The departments a user may select from is dictated by the setup in the Process Manager Accounts Payable – Invoice Entry process. Once the batch has been saved/created, the department cannot be changed.

Date – The date the batch is attributed to would appear here. The field defaults to today’s date but, can be changed if necessary. It is intended to indicate the date the batch was created. Once the batch has been saved, and created, the date cannot be changed.

Number – This dictates the batch number assigned when the batch is saved. Users can enter a batch number of their own choosing using up to 13 alphanumeric characters. If the field is left blank, the system will assign a batch number using the standard numbering convention of four digit year prefix, followed by leading zeros and the next sequentially available number. Once the batch has been saved/created, the batch number cannot be changed.

All fields that appear after the batch number can be changed after the batch has been saved and created.

Total – This field is an optional check sum, or control total. If the user enters an amount into this field, it is taken into account when the batch is validated. If the total of the invoices within the batch does not equal the amount entered into this field, the batch will fail validation. If the field is left blank, it is not used during the validation stage of the workflow.

Batch Description – This field is an optional description for the batch as a whole. It appears if a user hovers over the batch number while viewing the Invoice Batch List. It also shows on the edit and post listing created when the batch is processed through the workflow. This field is often used if the batch is for a specific purpose or, type of invoice such as Overpayment Refunds or, Juror Payments.

Vendor – If all or, most of the invoices to be entered into a batch are for the same vendor, the vendor can be defaulted in automatically. This will automatically populate onto each invoice on all consecutive entry screens.

Remittance – If a vendor default was selected, the primary remittance contact for the vendor will default into this field. If the vendor has multiple remittance contacts, the appropriate remittance contact can be selected to default into each invoice entry screen. If a default vendor was not selected, this field is not applicable.

Date – The invoice date in this field will default into this field as the invoice date for all invoices entered into this batch. The date defaults to today’s date, but, can be changed, or even cleared if it is desired. The field can be updated on each invoice entry screen to the appropriate invoice date for each individual invoice.

Due Date – The date in this field will default in as the invoice due date for all invoices entered into this batch. The date defaults to today’s date, but, can be changed or, even cleared if desired. The field can be updated on each invoice entry screen to the appropriate invoice date for each individual invoice.

G/L Date – The date in this field will default in as the invoice G/L date for all invoices entered into the batch. The date defaults to today’s date, but, can be changed or, even cleared if it is desired. The field can be updated on each invoice entry screen to the appropriate invoice date for each individual invoice.

Received Date – The date in this field will default in as the invoice received date for all invoices entered into the batch. The date defaults to today’s date but can be changed or, even cleared if it is desired. The field can be updated on each invoice entry screen to the appropriate invoice date for each individual invoice.

Paying Bank – If all of the invoices to be entered into the batch are to be paid from the same bank account, a default paying bank account can be selected so that it automatically populates onto each invoice entered in the batch.

Item – If all of the invoices to be entered into the batch are to be attributed to the same item, it can be defaulted in so that it automatically populates onto each invoice entered into the batch.

Description – If all of the invoices to be entered into the batch need the same header description, it can be defaulted in so that it automatically populates onto each invoice entered into the batch.

Amount – If all of the invoices to be entered into the batch are for the same amount, it can be defaulted in so that it automatically populates onto each invoice entered in the batch.

G/L Account – If all of the invoices to be entered into the batch are to be charged to the same G/L Account, it can be defaulted in so that it automatically populates onto each invoice entered in the batch.

Retain Entries – If selected, this check box dictates if a change is made to any of the fields that are defaulted in during the individual invoice entry screens, then the value the field was changed to will become the new default for the next invoice entry screen. If cleared, defaults will continue to populate as they were defined on the general page for the batch even if they are overridden on individual invoices.

Use G/L Defaults – If selected, G/L accounts can automatically populate onto the invoice entry screen based upon the default organization set the selected department is attributed to, and the primary expense account the selected item is attributed,

Due Date Based On – The available options are Balance Period and Discount Period. This field is only applicable if invoice terms are being used. When Balance Period is selected, the due date for an invoice can automatically be populated based on the balance period for the selected invoice term and the invoice date that was entered. Discount is populated based on the discount period for the selected invoice term and the invoice date that was entered.

Once the appropriate values have been defined for the batch, the buttons along the bottom of the General page can be used as follows.

Buttons:

Save – Click to save and create the batch. Once clicked, the application will automatically bring the user into the Invoice Entry screen.

Save/New – Click to save and create the batch. Afresh batch entry screen will appear. This button should be used if multiple batches need to be created before invoice entry into the batches begins.

Delete – Click to delete the batch. This button only becomes available after the batch has been saved.

Reset – Click to reset the batch or, General page settings to be exactly as they were as of the last save.

Once the batch has been saved and created, invoices can be entered into the batch.

The icons along the top of the screen become available after the batch has been created. If the cursor is positioned over an icon the description for the respective icon will display to the right of the icons. The page that the user is currently on, within the batch, is indicated by the highlighted icon. The icons are as follows:

General – The general icon can be clicked to navigate back to the batch settings to make any necessary changes.

General – The general icon can be clicked to navigate back to the batch settings to make any necessary changes.

List – This icon will take the user into the list of invoices that have currently been saved within the batch.

List – This icon will take the user into the list of invoices that have currently been saved within the batch.

The list also includes a summary fiscal section along the top where the user can see the respective totals based on the invoices that have been entered into the batch thus far.

From the list within the batch, a user can reopen previously entered invoices by clicking on the respective invoice number.

List Tab Buttons:

Delete – Selected invoices can be deleted by clicking into the respective row so the invoice is highlighted in yellow, and then, by clicking this button.

Refresh – Click this button to ensure the most current list of invoices within the batch is being viewed.

Export – Click this button to export information in the list. A pop up will open where the desired columns for export can be selected, along with the desired export format.

Reassign - Select invoices using the check boxes in the first column of the list, and reassign them into other batches by then clicking the Reassign button. This is often used by customers to move invoices that are at issue or, over budget, into a separate holding batch so that the invoices without issues within that batch can be processed.

Invoice Entry – This icon will take the user into the invoice entry screen where invoices can be added to the batch using the various methods of invoice entry.

Invoice Entry – This icon will take the user into the invoice entry screen where invoices can be added to the batch using the various methods of invoice entry.

Templates – This icon will take the user into a list of template batches and template invoices where the user can make a selection, using check boxes, to identify which template invoices should be brought into the batch. Click the accept button to add the selected templates into the new batch.

Templates – This icon will take the user into a list of template batches and template invoices where the user can make a selection, using check boxes, to identify which template invoices should be brought into the batch. Click the accept button to add the selected templates into the new batch.

HR Disbursements – This icon will take the user into a screen where HR Disbursement invoices, created by the payroll process, can be selected to be brought into the batch. These HR Disbursements include employer payroll taxes, employee withholding taxes, garnishments, both the employer and employee health care costs, etc., Search criteria are available to allow the user to narrow down to select HR Disbursement Invoices based on From and To Date, Vendor, Disbursement Type, and by Pay Batch. Disbursement invoices can then be brought into the invoice batch by using the check boxes to select. By clicking the Accept button,they will be brought into the batch. This icon is only available if the Human Resources application has been licensed.

HR Disbursements – This icon will take the user into a screen where HR Disbursement invoices, created by the payroll process, can be selected to be brought into the batch. These HR Disbursements include employer payroll taxes, employee withholding taxes, garnishments, both the employer and employee health care costs, etc., Search criteria are available to allow the user to narrow down to select HR Disbursement Invoices based on From and To Date, Vendor, Disbursement Type, and by Pay Batch. Disbursement invoices can then be brought into the invoice batch by using the check boxes to select. By clicking the Accept button,they will be brought into the batch. This icon is only available if the Human Resources application has been licensed.

Release Contract Retainage – This icon will take the user into a list of vendors and their respective contracts. From here, the user can select the contract and retainage amount to automatically create an invoice. Search criteria are available to narrow down based on the Vendor, and/or Contract. The user can then click the plus icon, to the left of the Vendor to see all of the contracts with retainage attributed to that vendor. Then use the check boxes to select which contract aretainage releasing invoice will be created. The user also has the ability to continue to drill down using the plus icons to see which invoices specifically had retainage withheld, and edit the amount to be remitted for each. After selecting the appropriate contracts to remit, and editing the amounts to be remitted, if desired, the user would then click the Accept button to add the retainage releasing invoice to the batch. This icon is only available if Contract Accounting has been licensed.